In 2025, the way Indians shop and pay online has completely evolved — UPI, mobile wallets, and contactless payments are now the standard for ecommerce in India. If your online store isn’t supporting these payment methods, you’re leaving serious money on the table.

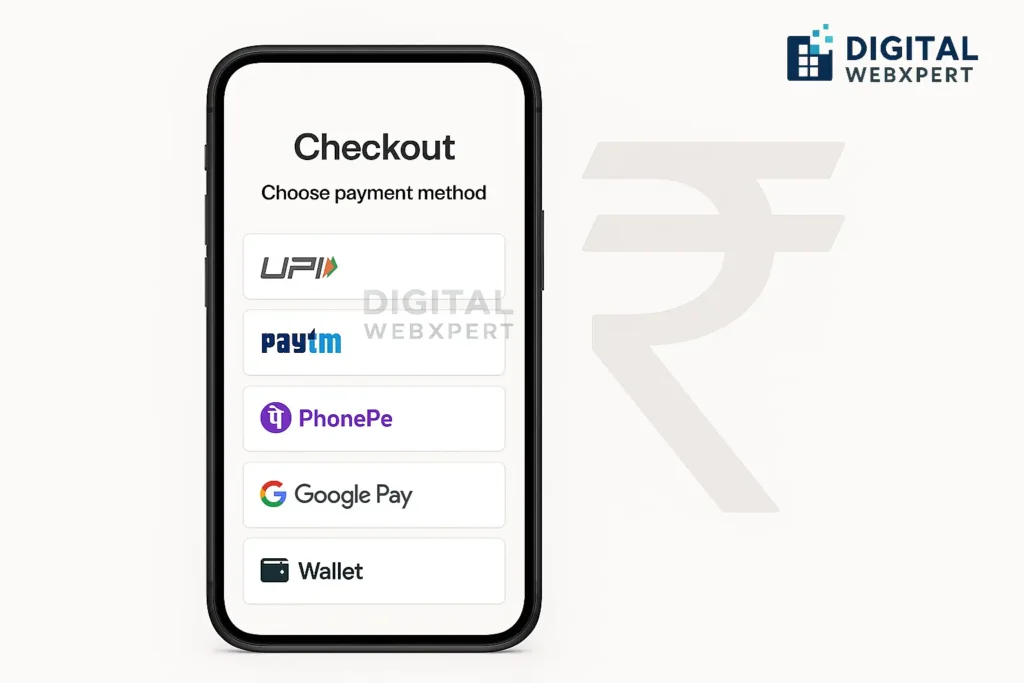

This guide will show you everything you need to know about Integrating UPI in ecommerce, supporting wallets like Paytm, PhonePe, and Google Pay, and optimizing your payment process for maximum conversions and trust.

Whether you’re a small business owner, startup founder, freelance web designer, or managing an ecommerce brand, this guide is tailored for digital success in India’s fintech-driven market.

📈 Why UPI & Wallet Integration Is Critical in 2025

UPI transactions in India crossed 14 billion monthly in 2025. With real-time processing, zero merchant fees (in many cases), and instant settlements, UPI is now more popular than credit or debit cards.

Mobile wallets like Paytm, PhonePe, Amazon Pay, and Google Pay dominate India’s mobile payment landscape. Together with UPI, they provide seamless payment options that:

Increase customer convenience

Boost mobile conversion rates

Reduce cart abandonment

Build buyer trust

If your store doesn’t offer them, customers will simply buy from a competitor that does.

🧩 Key Payment Options to Integrate

Here are the top-performing digital payment methods every ecommerce business in India should offer:

✅ 1. UPI (Unified Payments Interface)

Most trusted digital payment method in India

Supported by all major banks

Enables real-time payments via VPA (Virtual Payment Address)

✅ 2. Mobile Wallets

Paytm

PhonePe

Google Pay

Mobikwik

Amazon Pay

✅ 3. BNPL (Buy Now Pay Later)

Services like Simpl, LazyPay, ZestMoney are rising in popularity.

Useful for boosting AOV (Average Order Value)

✅ 4. Credit/Debit Cards

Still essential, especially for higher-ticket purchases

✅ 5. Net Banking

Popular among older consumers and business buyers

🛠️ How to Integrate UPI & Wallets into Your Ecommerce Store

Here’s a simplified step-by-step guide for integrating UPI in ecommerce, along with mobile wallets and other payment gateways:

🔌 Step 1: Choose the Right Payment Gateway Provider

Top Indian gateways that support UPI, wallets, and more:

| Payment Gateway | UPI | Wallets | Setup Fee | Notable Features |

|---|---|---|---|---|

| Razorpay | ✅ | ✅ | ₹0 | Easy API, BNPL options |

| Cashfree | ✅ | ✅ | ₹0 | Instant settlements |

| PayU | ✅ | ✅ | Varies | EMI, subscriptions |

| CCAvenue | ✅ | ✅ | ₹1,200 | Strong legacy network |

| Instamojo | ✅ | ✅ | ₹0 | Great for small businesses |

💡 Tip: Choose a provider that offers plug-and-play integrations with WooCommerce, Shopify, Magento, etc.

🔧 Step 2: Enable UPI & Wallet Options

Once you sign up with your gateway:

Log in to the dashboard

Enable UPI and your preferred wallets

Add relevant credentials or keys

Update your store’s checkout settings

For example, with Razorpay for WordPress:

🎨 Step 3: Optimize Checkout UX for Mobile Payments

In 2025, most digital payments are mobile-first. Here’s how to boost your conversions:

Show UPI/Wallet options first on mobile

Display trust badges (SSL, RBI compliant)

Highlight “Secure UPI Payment” near the CTA

Add a UPI QR code for desktop orders

🔁 Step 4: Offer Post-Payment Confirmation & Smart Tracking

Once the transaction completes:

Show a real-time confirmation screen

Email/SMS the order summary

Redirect to thank-you page with related offers

Tracking tools like Google Tag Manager or Facebook Pixel should be linked to your payment confirmation for analytics and remarketing.

🔐 Security, Compliance & Trust Factors

✔️ RBI Compliance

Ensure your gateway is RBI-compliant and follows KYC norms.

✔️ PCI-DSS Certification

Required if handling card data directly.

✔️ SSL Encryption

Must-have for all ecommerce sites in India.

✔️ Display Support Contact

Display customer support channels in case of payment failure or delay.

💼 Real-World Use Case

Client: Local Clothing Brand, Mumbai

Problem: High cart abandonment

Solution: Added UPI + PhonePe at top of checkout

Result: +31% increase in completed transactions in 2 months

💬 “Once we added UPI and PhonePe, our sales shot up. Most of our buyers were mobile-first, and this made checkout seamless.” — Client Testimonial

💡 Quick Tips to Boost Sales with UPI & Wallets

Highlight “Pay with UPI & Save” on product pages

Run cashback offers through wallets like Amazon Pay

Provide instant refunds for UPI transactions

Include UPI AutoPay for subscriptions or memberships

Use exit-intent popups offering discounts via wallet payment

🎯 Final Thoughts

Integrating UPI in ecommerce and offering mobile wallets is no longer optional — it’s a sales-boosting necessity for the Indian ecommerce market in 2025.

By enabling these smart, seamless, and secure payment options, you not only build trust but also remove friction from your customer’s buying journey. Whether you’re selling fashion, courses, services, or SaaS — the right payment setup can significantly impact your bottom line.

✅ Need help setting up UPI & Wallet Payments on your ecommerce store? Contact Digital WebXpert for expert integration, design, and conversion optimization solutions.